Bitcoin falls under $91K — Bitfinex says it’s at a ‘critical juncture’

Bitfinex analysts said Bitcoin is mirroring traditional markets, and its lack of price momentum has “led to a period of contraction” for crypto markets.

Bitcoin fell under $91,000 and is at a “critical juncture” after the cryptocurrency has seen nearly 90 days of tight range-bound trading, according to analysts at crypto exchange Bitfinex.

Bitcoin $89,449 has traded between $91,000 and $102,000 for around three months amid a stall in market momentum and “remains at a critical juncture after nearly 90 days of consolidation,” analysts said in the Feb. 24 Bitfinex Alpha report.

“The momentum required for a sustained breakout has been lacking, and this has led to a period of contraction and consolidation across almost all major crypto assets,” the analysts said.

“The momentum required for a sustained breakout has been lacking, and this has led to a period of contraction and consolidation across almost all major crypto assets,” the analysts said.

Bitcoin has fallen over 4.5% in the past 24 hours, hitting a low of under $91,000 — its lowest price since late November, according to CoinGecko. The wider crypto market has also fallen 8% in the past day, from over $3.31 trillion to around $3.09 trillion.

The market drop comes as Trump said at a Feb. 24 news conference with French President Emmanuel Macron that his planned 25% tariffs on Canada and Mexico “are going forward on time, on schedule.”

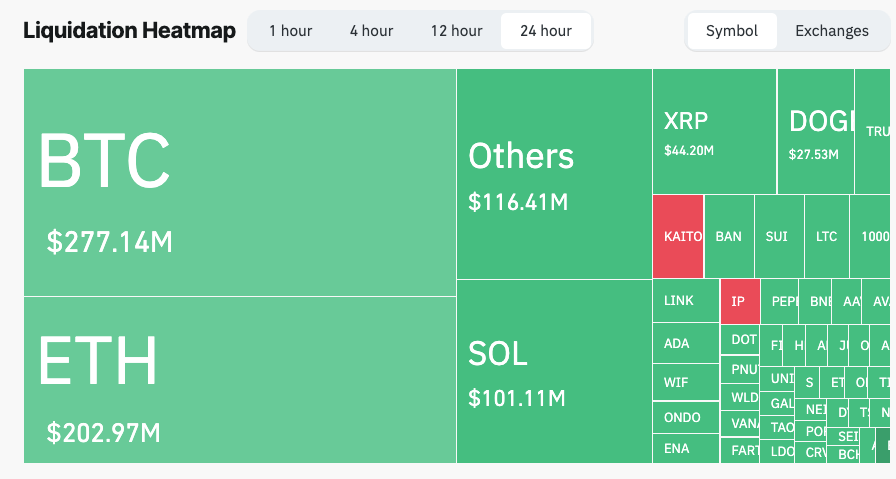

The crypto market fall sparked a cascade of liquidations, with over $961.65 million liquidated in the last day, split between $891.52 million long bets and $70.14 million short bets, CoinGlass data shows.

Long Bitcoin bets took the lion’s share of liquidations, with over $277 million wiped out in the past day.

Bitfinex analysts said that Bitcoin is increasingly correlating with traditional markets, and a major factor affecting a stalled crypto market is “a similar stagnation in traditional financial markets” that’s been brought about by “macro-driven uncertainty.”

The S&P 500 has fallen by 2.3% in the last five trading days, while the Nasdaq Composite has dropped 4% over that same time. Bitfinex said that the “broader equity marketʼs suppression has affected risk assets in general, including cryptocurrencies.”

e analysts added that institutional demand for Bitcoin through spot exchange-traded funds has also “slowed significantly,” seeing outflows on every trading day for the week ending Feb. 21 totaling $552.5 million.